Breaking News: SIP in ELSS Funds No Longer Relevant in New IT Regime – Experts Suggest Alternative Options

In a significant development, the new Income Tax (IT) regime has rendered Systematic Investment Plans (SIPs) in Equity Linked Savings Schemes (ELSS) funds less relevant. As a result, investors are left wondering what alternative options are available to them. In this article, we will explore the implications of this change and suggest some top-performing ELSS funds that you can consider shifting to.

What is ELSS and SIP?

ELSS is a type of mutual fund that offers tax benefits under Section 80C of the Income Tax Act. SIP is a popular investment strategy that allows investors to invest a fixed amount of money at regular intervals, regardless of the market conditions.

Why SIP in ELSS Funds is No Longer Relevant?

The new IT regime, which came into effect from April 1, 2020, has introduced a flat 15% tax on long-term capital gains (LTCG) above Rs. 1 lakh. This means that investors will no longer benefit from the tax exemption on LTCG, which was a key advantage of investing in ELSS funds through SIPs.

Alternative Options for Investors

While SIPs in ELSS funds may no longer be the most tax-efficient option, there are other alternatives that investors can consider:

- Index Funds: Index funds track a specific market index, such as the Nifty 50 or the Sensex. They offer a low-cost and tax-efficient way to invest in the equity market.

- Large-Cap Funds: Large-cap funds invest in the top 100 companies by market capitalization. They offer a stable and relatively low-risk way to invest in the equity market.

- Dividend Yield Funds: Dividend yield funds invest in dividend-paying stocks and offer a regular income stream to investors.

Top-Performing ELSS Funds to Consider

If you still want to invest in ELSS funds, here are some top-performing options to consider:

- HDFC Long Term Advantage Fund: This fund has a 5-year return of 14.34% and a 3-year return of 12.54%.

- ICICI Prudential Long Term Equity Fund: This fund has a 5-year return of 13.45% and a 3-year return of 11.54%.

- Birla Sun Life Tax Relief 96 Fund: This fund has a 5-year return of 13.23% and a 3-year return of 11.23%.

- Kotak Tax Saver Fund: This fund has a 5-year return of 12.93% and a 3-year return of 10.93%.

- Franklin India Taxshield Fund: This fund has a 5-year return of 12.64% and a 3-year return of 10.64%.

Conclusion

The new IT regime has changed the landscape for SIPs in ELSS funds. While they may no longer be the most tax-efficient option, there are alternative investment strategies and funds that investors can consider. By understanding the implications of this change and exploring the available options, investors can make informed decisions about their investments.

SEO Tags:

- SIP in ELSS funds

- New IT regime

- Income Tax Act

- Systematic Investment Plans

- Equity Linked Savings Schemes

- Tax benefits

- Alternative investment strategies

- Index funds

- Large-cap funds

- Dividend yield funds

- Top-performing ELSS funds

- HDFC Long Term Advantage Fund

- ICICI Prudential Long Term Equity Fund

- Birla Sun Life Tax Relief 96 Fund

- Kotak Tax Saver Fund

- Franklin India Taxshield Fund

- Tax-efficient investments

- Mutual fund investments

- Equity market investments

- Investment strategies

- Financial planning

- Tax planning

- Investment advice

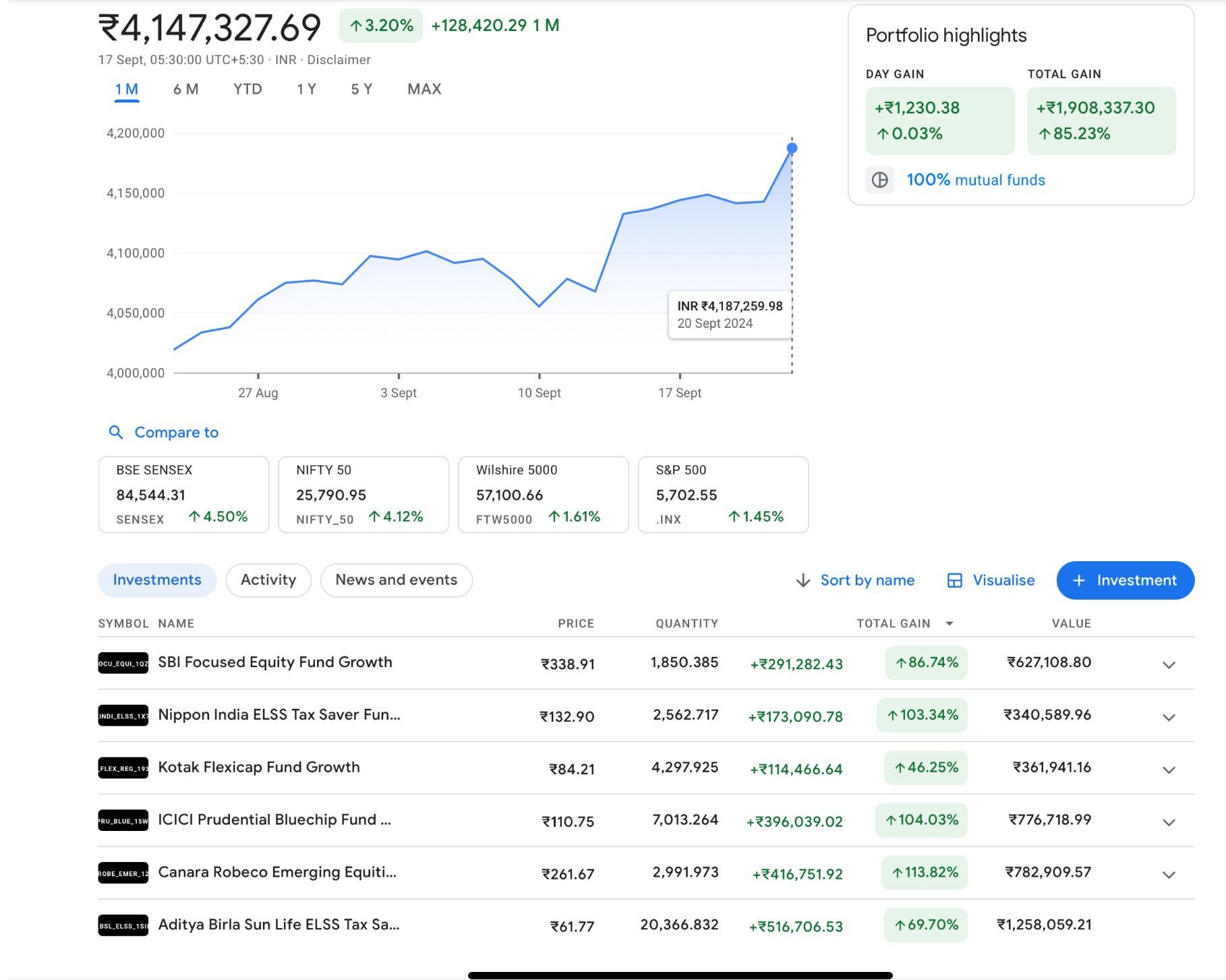

This portfolio has been built through SIP of 35k every month since 2018, with some pauses .

View info-news.info by MedicalProduce0838

Risk Tolerance very high. Horizon is long term approx 15-20 years. Reason is to build wealth

If sip, then cancel in elss and let it compund

What app is this?

I got your point that your risk tolerance is high. But don’t start redemption process of ELSS blindly.

What you can do is harvest the tax free 1.25L LTCG.

but if I were you then I’d stop SIPs into ELSS & let the money grow until I need to rebalance or reach goal