This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

The weight of high expectations is often a heavy burden to carry.

In life, if you are a top performer at work, it’s expected that you will show up to be a top performer every single day. Having a bad day? That’s not allowed, so go sling that crap somewhere else.

Sure, some college professor who gave an inspiring leadership speech at a TED Talk 10 years ago and is now appearing in one-minute clips on your Instagram feed might suggest it’s OK to have bad days at work, even if you are a winner.

Trust me, it’s not — and don’t let that social clip allow you to think otherwise.

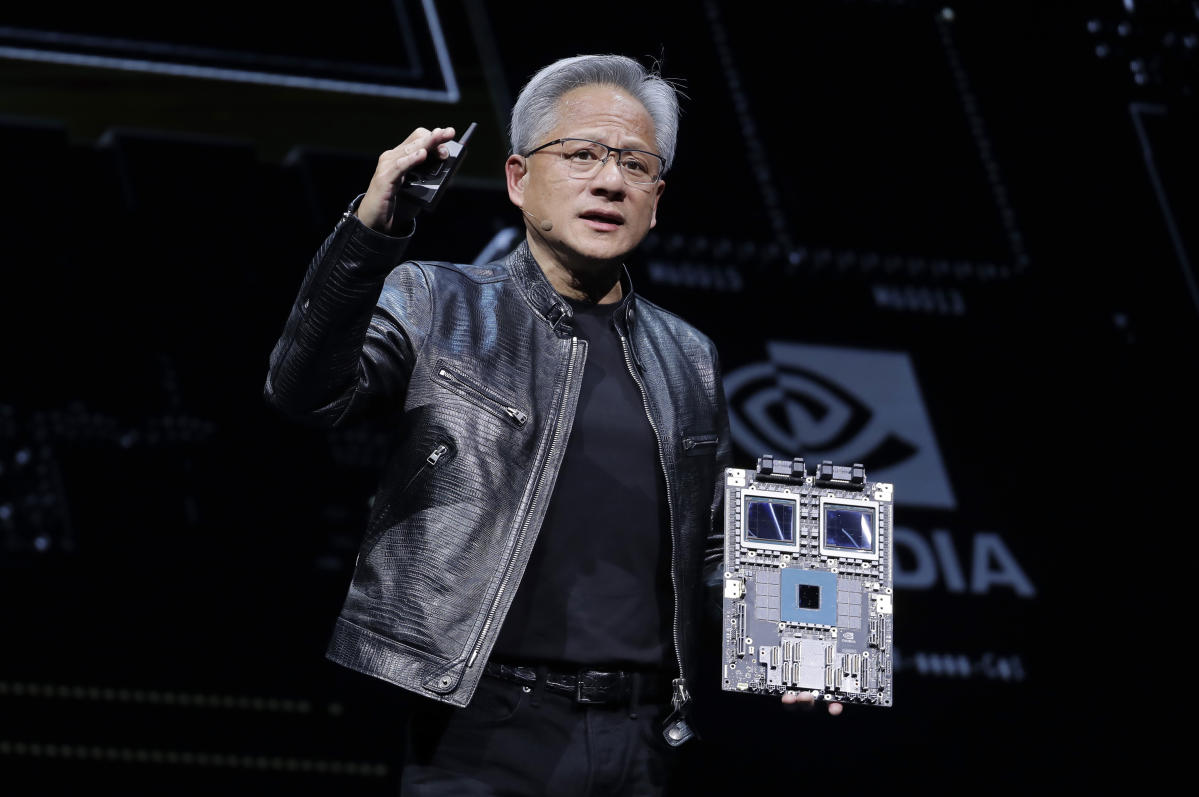

This same philosophy could be applied to the stock market’s most important stock: Nvidia (NVDA).

I know you like that transition, Morning Brief readers! Hear me out on this top performer in the market.

Over the past week, we were reminded of how inflated expectations are for Nvidia and how the stock has entered dangerous waters that many traders who arrived late to the Nvidia game have never navigated before.

On June 18, Nvidia’s market cap hit a staggering $3.34 trillion, eclipsing Microsoft (MSFT) to become the world’s most valuable company. Over the next three trading days, on seemingly no fundamental news, the company shed $430 billion in market cap.

For perspective, Coca-Cola’s (KO) market cap is $275 billion.

Some folks I talked with told me people were taking profits on Nvidia going into the start of the second half of the year. Others I talked to for my “Opening Bid” podcast told me there is some chatter about new competitors entering Nvidia’s turf, and maybe the company won’t be as absurdly dominant over the next five years as many anticipate.

All of that is fair, but it reinforces the view that the stock is prone to sharp, out-of-the-blue negative shifts in sentiment because it’s up 3,000% in five years.

But if you drill down further, you can see just how intense the expectations on Nvidia have become.

-

Nvidia’s stock now trades at about 21x (super steep) forward sales, up from 12x (also steep) two months ago, according to research from Creative Planning chief market strategist Charlie Bilello. This is a significant premium over Microsoft at 12x and Apple (AAPL) at 8x, two tech titans that are performing very well fundamentally and are likely to continue rocking years ahead.

-

Nvidia’s stock recently traded about 100% above its 200-day moving average, BTIG chief market technician Jonathan Krinsky pointed out. Since 1990, the widest spread that any US company has ever traded above its 200-day moving average while it was the largest company in the world was 80% by Cisco (CSCO) in March 2000, which marked its all-time high. “In other words, Nvidia is in a league of its own,” Krinsky said.

It sure seems that way.

Similar expectations were applied to chipmaker Micron (MU) going into earnings this week. The stock got blasted due to “in-line” guidance that didn’t meet crazy expectations for anything tied to AI demand.

And I emphasize crazy: On Monday, several sell-side analysts jacked up their estimates and price targets on Micron ahead of the report. As someone who used to manage a team of stock researchers, I can tell you that this action heading into an earnings report is not the norm.

It reeked of analysts buying into the hype too much and hoping for a giant one-day pop in the stock.

“When you get a reaction like Micron’s, where the numbers should be good enough to avoid a sell-off, let alone spur a rally, that’s a bad sign — a tell that expectations are so high that they can’t be exceeded,” Interactive Brokers chief strategist Steve Sosnick told me.

Others don’t agree with my assessment that Nvidia is priced for perfection, and that is totally fine. I don’t have a monopoly on good ideas!

“But for medium- to longer-term investors, the story still holds when we look at how far out their capacity is booked and pricing is firming,” Tematica Research co-founder and chief investment officer Chris Versace said.

One thing we can all agree on: Nvidia is a top-performing employee in the market, and it will get no pass for trying to take a day off if it catches a cold.

Speaking of expensive tech stocks, shares of Amazon (AMZN) are up 55% in the past year. Questions linger about its culture, however. WSJ reporter Dana Mattioli talked about her explosive new book “The Everything War: Amazon’s Ruthless Quest to Own the World and Remake Corporate Power” in an episode of the “Opening Bid” podcast. Listen in below.

This embedded content is not available in your region.

Opening Bid Episode List

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

#Nvidia #stock #treacherous #waters #Morning,

#Nvidia #stock #treacherous #waters #Morning