BREAKING NEWS: Credit Spreads Return to Calm, Signaling Market Resilience

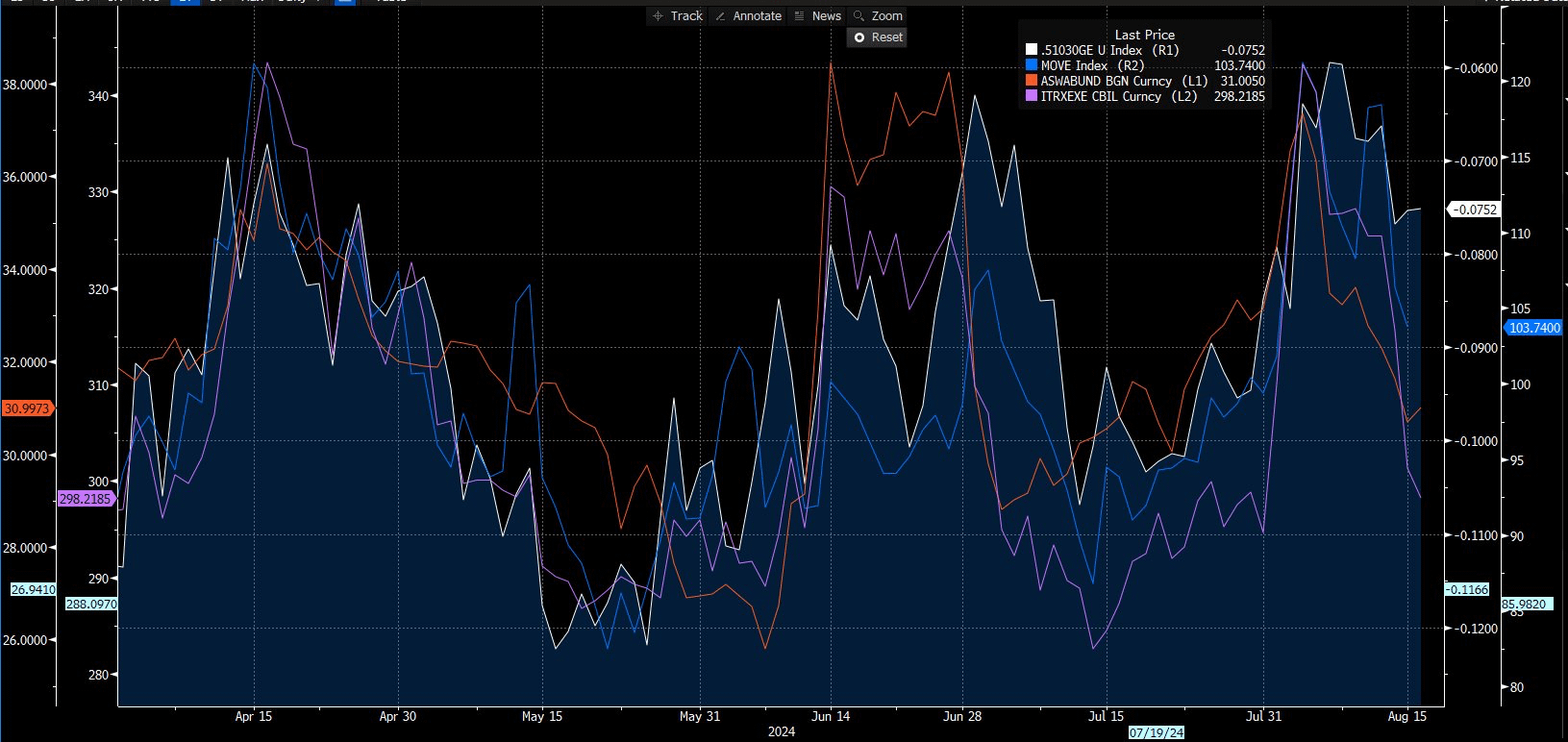

As the dust settles on the recent market turbulence, a telling sign has emerged that contradicts the notion of a prolonged market downturn. Credit spreads, a gauge of market stress and investor sentiment, have plummeted to levels seen in May, defying expectations of a sustained selloff.

Credit Spreads: A Canary in the Coal Mine

In the midst of the sell-off, one would have expected credit spreads to widen significantly, reflecting heightened market stress and increased risk aversion. However, despite the volatility, credit spreads never truly spiked in a historically significant way. This anomaly has proven to be a harbinger of the market’s underlying resilience.

The Message in the Market

The recent collapse in credit spreads to May levels is a clear indication that the market is rapidly returning to a state of equilibrium. This sudden reversal is a testament to the remarkable ability of the global financial system to absorb and respond to shocks. With credit spreads compressing, investors can breathe a sigh of relief, knowing that the market is regaining its footing.

Liquidity Revival: A Boon for the Market

Lower credit spreads are not only a reflection of improved market sentiment but also a direct result of increased liquidity. As investors grow more confident, they become more willing to engage in transactions, driving up demand and compressing credit spreads. This, in turn, fosters a more supportive environment for the market, allowing equities to continue their upward trajectory.

Market Implications

The rapid descent of credit spreads has far-reaching implications for the market. With liquidity returning to normal, investors can expect:

- A continued reduction in market volatility

- Increased appetite for risk-taking

- A renewed focus on growth-oriented stocks

- Potential for new highs in major indices

Stay Ahead of the Curve with Our Market Analysis

As the market continues to evolve, stay informed with our real-time analysis and commentary. Our team of experts will guide you through the complexities of credit spreads and market dynamics, providing valuable insights to inform your investment decisions.

Keywords: credit spreads, market analysis, liquidity, financial markets, market trends, stock market, equities, investor sentiment, market volatility, risk management.

Follow us for more breaking news and market insights: [Your Website URL]

Subscribe to our newsletter for in-depth analysis and exclusive market updates: [Your Newsletter Link]

Social Media Links: Follow us on [Twitter], [Facebook], [LinkedIn] for the latest news and market insights.

Credit spreads never really spiked in a way that was historically significant, and that was the sign that the sell off was not going to last. nonetheless, we see that credit spreads have crushed back down to May levels. Lower credit spreads = more liquidity = good for the market.

View info-news.info by TearRepresentative56