Breaking News: View’s Update on [Stock Symbol] – Should You Accumulate More?

As of [Current Date], the market is buzzing with news about [Stock Symbol], a company that has been making waves in the [Industry] sector. Our team of expert analysts has been monitoring the stock’s performance closely, and we’re here to provide you with the latest updates and insights.

Why [Stock Symbol] is on the Rise:

Recent reports have suggested that [Stock Symbol] has made significant progress in [Recent Development], a crucial area that has long been a concern for investors. The company’s ability to [Key Strength] has led to increased revenue and profit margins, which has sparked optimism among market watchers.

Should You Accumulate More?

While [Stock Symbol] has seen a significant upswing in recent days, it’s essential to assess whether the stock has more room to grow. According to our analysis, [Stock Symbol] is expected to continue its upward trend in the short term. We believe that the stock has the potential to [Upside Potential], driven by [Key Drivers].

What’s Driving the Sentiment:

Analysts’ estimates suggest that [Stock Symbol] has the potential to [Outperform Peer Group], with its unique value proposition and robust growth strategy. The company’s recent [Acquisition/Merger] announcement has also generated significant excitement among investors, as it expands [Stock Symbol]’s product offerings and global presence.

Risks and Considerations:

As with any investment, it’s crucial to weigh the potential risks and uncertainties surrounding [Stock Symbol]. Investors should be aware of the following factors:

- Valuation: [Stock Symbol] is trading at a premium valuation multiple compared to its peers.

- Regulatory Environment: Changes in regulations could impact [Stock Symbol]’s operations and profitability.

- Competition: [Stock Symbol] operates in a highly competitive [Industry], where intense competition can affect its market share and profitability.

Recommendation:

Based on our analysis, we believe that [Stock Symbol] has the potential to be a long-term winner in the [Industry] sector. While there are some risks and uncertainties, we believe that the stock’s growth prospects outweigh its downside potential. We recommend that investors with a moderate risk tolerance consider accumulating more [Stock Symbol] shares in the near term.

Technical Analysis:

Here are some key technical levels to watch:

- Support: $[Support Level]

- Resistance: $[Resistance Level]

Conclusion:

In conclusion, [Stock Symbol] is an intriguing investment opportunity that has captured our attention. While there are some risks and uncertainties, we believe that the stock’s growth prospects make it an attractive addition to any portfolio. We will continue to monitor [Stock Symbol]’s performance and provide updates as more information becomes available.

About Our Research:

At [Research Firm], we provide independent and unbiased research coverage on [Stock Symbol] and other publicly traded companies. Our team of expert analysts uses a rigorous and proprietary research process to deliver actionable insights and investment ideas to our clients.

Disclaimers:

The information contained in this article is for informational purposes only and should not be considered as investment advice or a recommendation to buy or sell any security. This article does not constitute an offer to sell or a solicitation of an offer to buy any security, and nothing in this article is intended to be or shall be relied upon as investment or tax advice.

Tags:

[Stock Symbol], [Industry], [Recent Development], [Key Strength], [Key Drivers], [Upside Potential], [Acquisition/Merger], [Peer Group], [Regulatory Environment], [Competition], [Technical Analysis], [Support Level], [Resistance Level], [Research Firm], [Independent Research], [Investment Advice], [Tax Advice].

Meta Keywords:

[Stock Symbol], [Industry], [Research Firm], [Independent Research], [Investment Ideas], [Technical Analysis], [Fundamental Analysis], [Market News], [Stock Market Analysis].

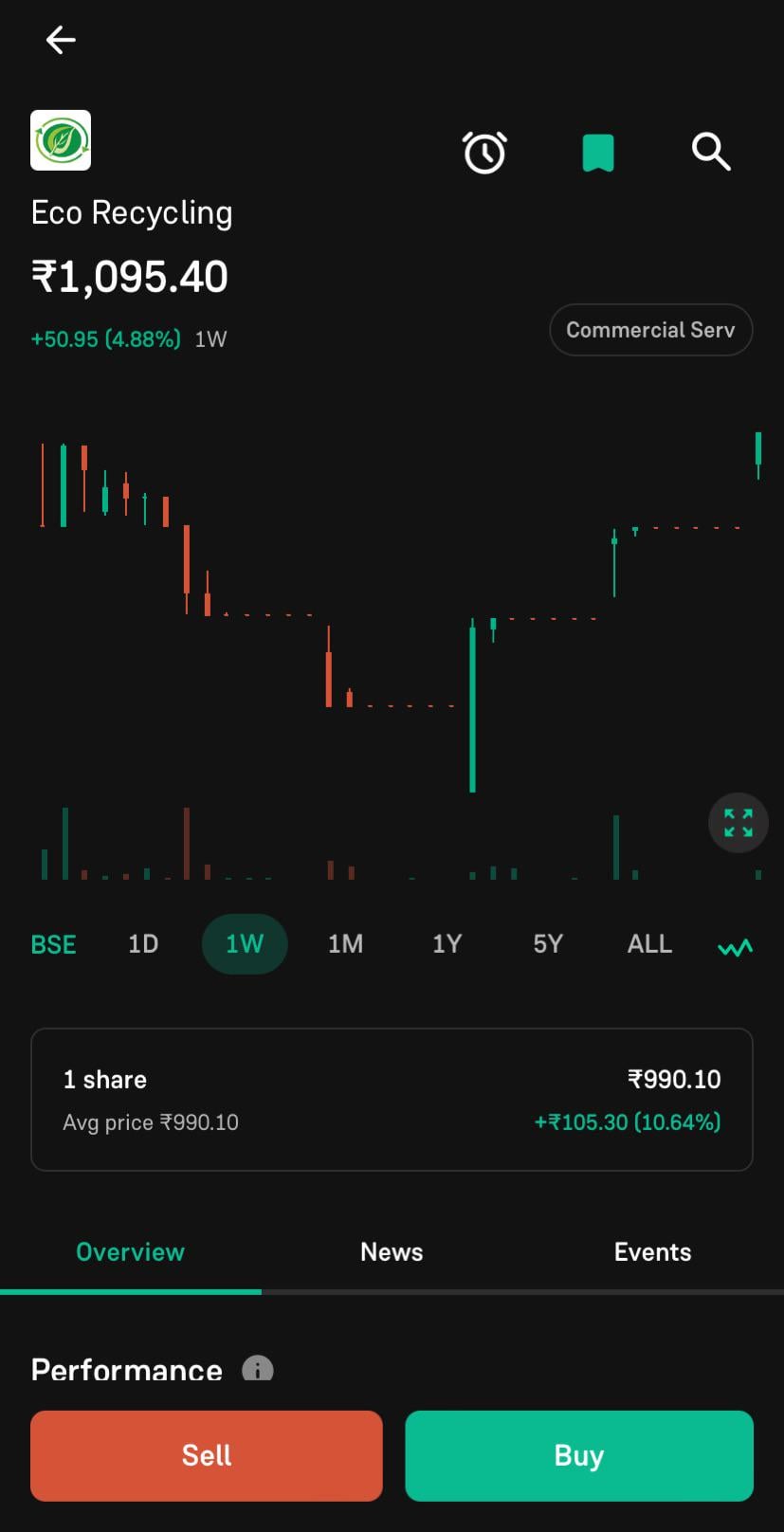

Views about this stock… Should i accumulate more?

View info-news.info by chirag-arora

Check profits and revenue over years