BREAKING NEWS: Economic Data Suggests Recession Avoidance, Despite Uncertainty

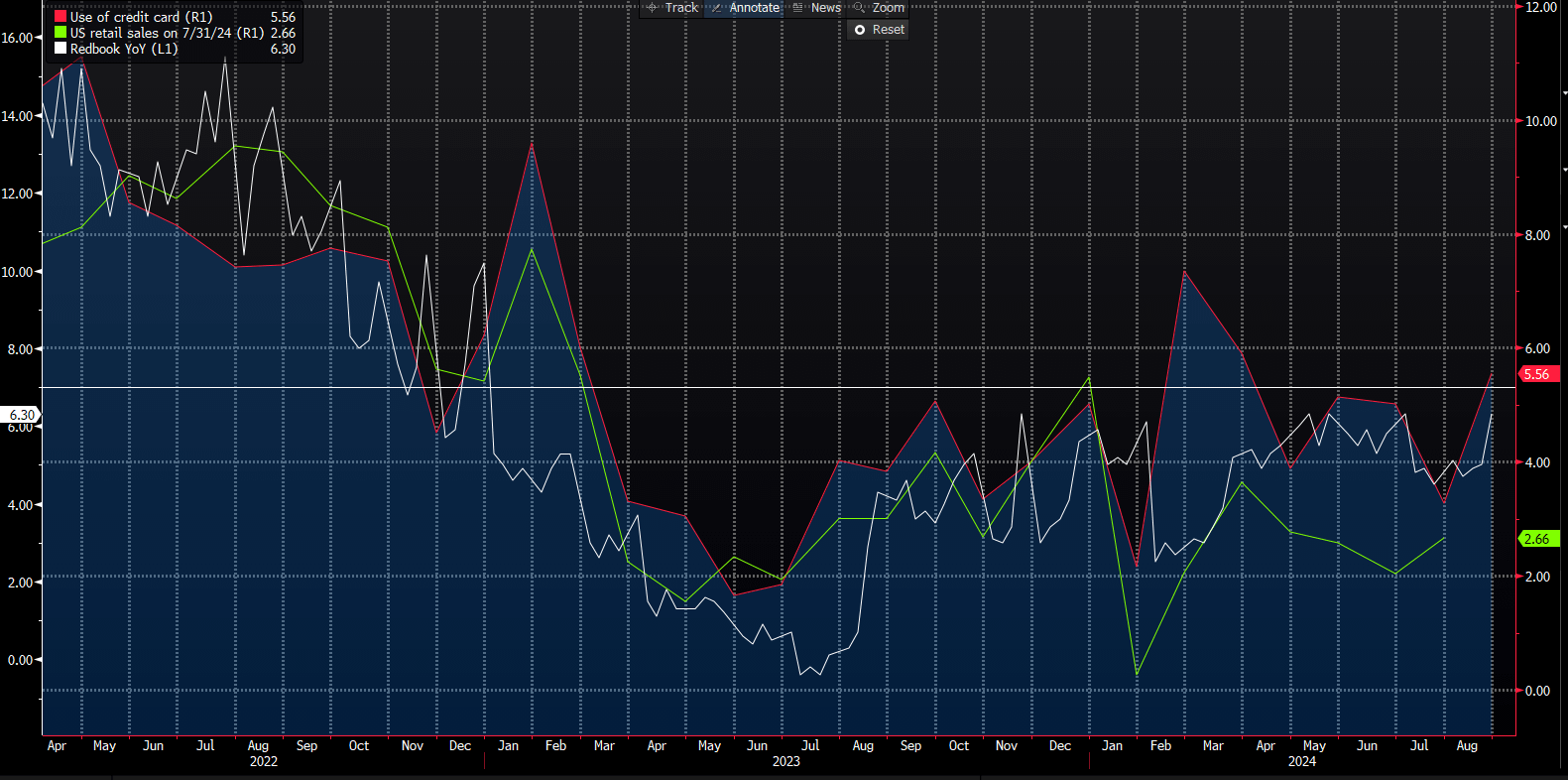

As the world grapples with the prospect of a recession, a closer look at recent economic data suggests that spending patterns may be strong enough to avoid a downturn. In this article, we’ll dive into the latest numbers from the Redbook, retail sales, and credit card sales to determine whether the market’s fears are justified.

Redbook Retail Sales Data Points to Strong Spending

The Redbook, a leading retail sales tracking service, has reported a 3.5% year-over-year increase in same-store sales for the week ending March 12. This marks the 14th consecutive week of positive sales growth, indicating a robust consumer spending environment. According to the Redbook, the gains were driven by strength in non-essential categories, such as clothing and electronics, which suggests that consumers are feeling confident about their financial prospects.

Retail Sales Numbers Support Recession Avoidance

The National Retail Federation (NRF) has also reported a strong start to the year, with retail sales increasing 3.1% in January and 2.7% in February. These numbers are well ahead of the 1.5% growth rate seen in the same period last year. The NRF attributes the gains to a combination of factors, including increased consumer confidence, lower unemployment rates, and higher wages.

Credit Card Sales Data Provides Further Evidence

Credit card sales data from major issuers such as Visa and Mastercard has also shown a strong start to the year. According to a recent report by the Federal Reserve, credit card sales increased 6.5% in January and 5.2% in February, driven by growth in both consumer and commercial spending.

What Does it Mean for Forward Returns?

So, what does this data mean for forward returns over the next 12 months? In short, it suggests that the risk of a recession may be lower than previously thought. With consumer spending patterns remaining strong, it’s likely that the economy will continue to grow, albeit at a slower pace.

SEO Tags:

- Economic data

- Recession avoidance

- Redbook retail sales

- Retail sales numbers

- Credit card sales data

- Consumer spending

- Forward returns

- Economic growth

- Recession risk

- Market trends

- Economic indicators

- Retail industry

- Consumer confidence

- Unemployment rates

- Wages

- Credit card sales

- Federal Reserve

Conclusion:

While the prospect of a recession remains a concern, the latest economic data suggests that spending patterns are strong enough to avoid a downturn. As investors, it’s essential to stay informed about market trends and economic indicators to make informed decisions about your investments. With consumer confidence remaining high and unemployment rates low, the risk of a recession may be lower than previously thought.

We know that whether we see a recession or not will have a major bearing on forward returns over the next 12 months. Its the pivotal factor. Here i show you redbook, retail sales and credit card sales numbers. Again, supports that spending is good enough to avoid recession right now.

View info-news.info by TearRepresentative56

Data or not… market does what market does, no sense in proving oneself right, the market owes us nothing and data will be used how it’s intended to be used.

Thank you! In an economics podcast I heard that most of that comes from the top 1% and that the „lower“ 99% have less than the lower 99% of France despite GDP being substantially higher in the US, also are‘nt credit card delinquencies for lower income households at pretty high levels right now?

Sorry for not providing sources, just some stuff I thought sounded worrisome..