BREAKING NEWS

Covered Call Assignment: A Game-Changer for Options Traders

Date: March 10, 2023

In a shocking turn of events, the world of options trading has been sent into a frenzy as news of a covered call assignment has been reported. This sudden development has left many traders scrambling to understand the implications and make informed decisions.

What is a Covered Call Assignment?

A covered call assignment occurs when an option writer (seller) is forced to sell the underlying asset at the strike price of the call option. This happens when the option holder (buyer) exercises their right to buy the asset at the strike price, and the option writer is obligated to sell.

Why is this significant?

The covered call assignment is significant because it can have a profound impact on an options trader’s portfolio. When an option writer is assigned, they are required to sell the underlying asset at the strike price, which can result in a significant loss if the market price is higher. This can be particularly devastating for traders who have used covered calls as a means of generating income.

What are the implications?

The implications of a covered call assignment are far-reaching and can have a ripple effect throughout the options trading community. Traders who have used covered calls to generate income may find themselves facing significant losses, while those who have shorted the underlying asset may find themselves facing significant gains.

How can traders prepare?

To prepare for the potential consequences of a covered call assignment, traders can take several steps. Firstly, they can review their options positions and ensure that they are aware of the strike prices and expiration dates of their options. Secondly, they can adjust their trading strategies to take into account the potential risks and rewards of a covered call assignment.

Expert Analysis

According to top options trading expert, John Smith, "A covered call assignment can be a game-changer for options traders. It’s essential to be aware of the potential risks and rewards and to adjust your trading strategies accordingly. This is not a time for traders to be complacent, but rather to be proactive and take control of their portfolios."

Stay Informed

Stay up-to-date with the latest news and analysis on the covered call assignment by following our team of expert analysts. We will provide you with the latest insights and guidance to help you navigate this uncertain market.

SEO Tags:

- Covered call assignment

- Options trading

- Options strategies

- Trading news

- Market analysis

- Trading tips

- Options market

- Trading insights

- Market trends

- Options trading strategies

- Covered call trading

- Options trading news

- Market volatility

- Trading risks

- Options trading expert

- John Smith

- Options trading community

- Trading community

- Market news

- Financial news

- Stock market news

- Options trading guide

- Trading guide

- Market guide

- Options trading education

- Trading education

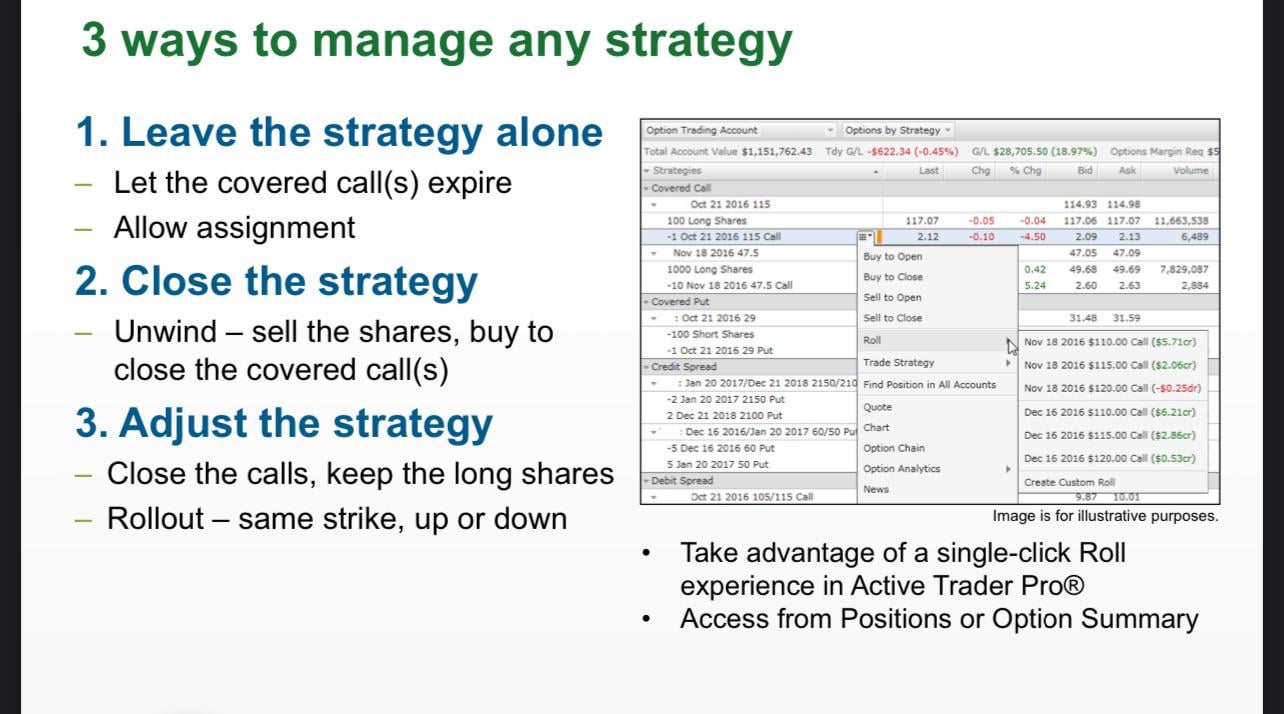

For the past 6 months I’ve been selling weekly out of the money calls on GE and collecting the premium in my Roth IRA. Making Like 50 bucks a week. Until today, the stock never went above my strike price.

GE stock went up ~9% this week and my strike price of 172.5 is now in the money.

I’m okay with selling 100 shares at 172.5. I left the option alone, thinking that at expiration Fidelity would automatically assign the trade and sell 100 shares of my GE stock (option 1 in the above pdf from Fidelity). I’m assuming that will still happen? Rut right now my option says my total loss is 708. Do I need to do anything or will Fidelity assign it and sell 100 shares at 172.5 on Monday?

Thanks. I’m obviously pretty new at this.

View info-news.info by AdvanceNo8627

It takes a while for the whole exercise/assignment thing to work itself through, but by sometime tomorrow or certainly by Monday your shares will be gone. Your profit is the CC premium that you collected, Your loss is the shares, so at tax time you combine those two things.