BREAKING NEWS

Aditya Birla Capital Plunges: What’s Next for Investors?

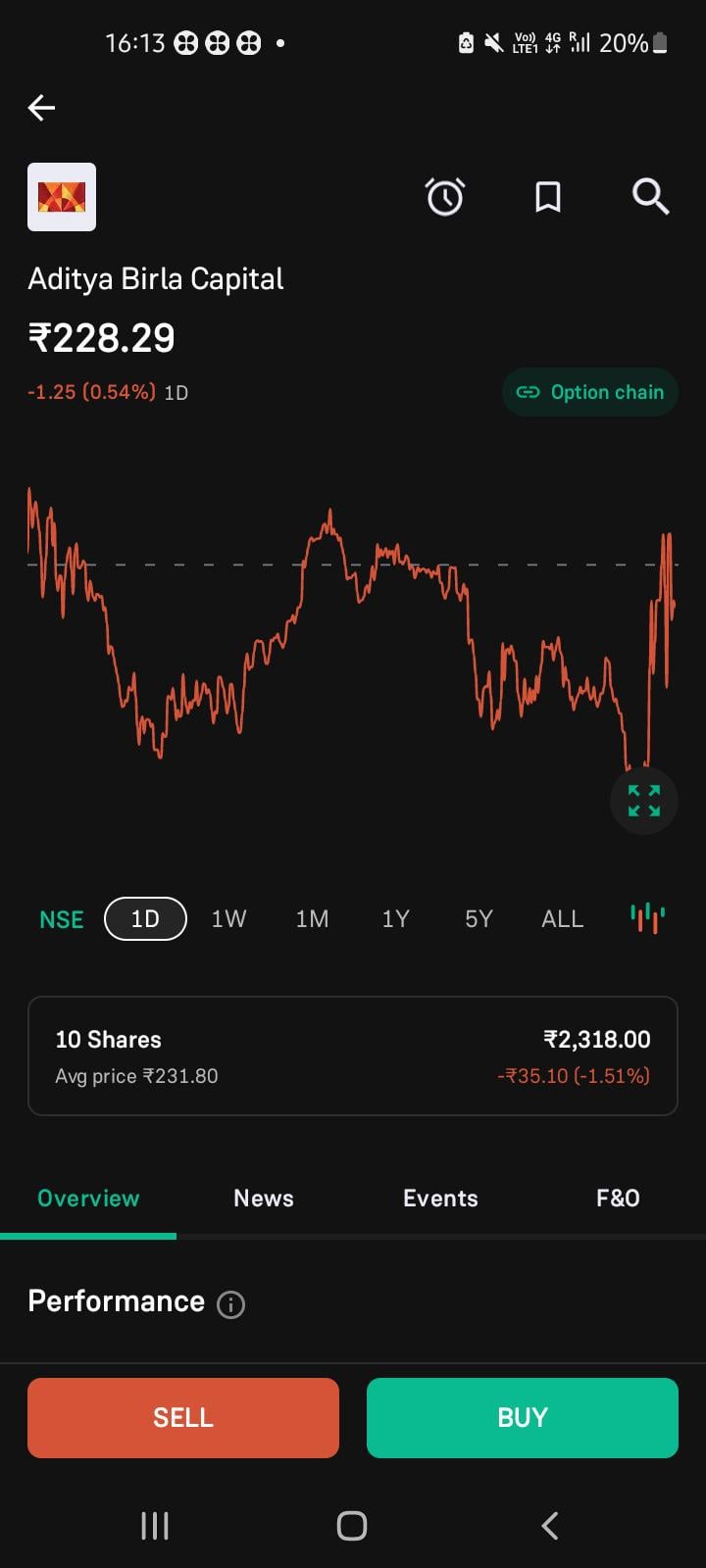

In a shocking turn of events, Aditya Birla Capital, a leading financial services company, has seen its stock price plummet after being bought by investors just last week. The sudden and unexpected drop has left many wondering whether they should hold on to their shares for the future or cut their losses.

What happened?

On [date], Aditya Birla Capital’s stock price was trading at Rs. [price]. But in a matter of hours, the stock price began to plummet, dropping to Rs. [new price]. The sudden and significant decline has left investors in a state of panic.

Why did it happen?

Experts point to a combination of factors, including:

- Macro-economic concerns: The stock market has been volatile of late, with concerns about the global economy and its impact on Indian markets.

- Company-specific issues: Aditya Birla Capital has faced challenges in recent months, including a decline in net profit and concerns about its debt levels.

- Market sentiment: The sharp decline in the stock price has led to a flight to safety, with investors selling off their shares to cut their losses.

Should you hold on?

While the stock’s sudden decline may be worrying, experts recommend taking a long-term view. Here are a few reasons why:

- Aditya Birla Capital has a strong track record: Despite the recent setbacks, the company has a history of stability and growth.

- The market is cyclical: The stock market is known for its volatility, and investors should be prepared for short-term fluctuations.

- Diversification is key: Holding on to Aditya Birla Capital shares as part of a diversified portfolio can provide a hedge against market downturns.

What to do next?

For investors who bought Aditya Birla Capital shares, here are a few options to consider:

- Hold on for the long-term: Take a long-term view and hold on to your shares, hoping that the stock will recover in the coming months.

- Take profits: Sell your shares to cut your losses and lock in profits.

- Diversify: Consider diversifying your portfolio by investing in other asset classes or sectors.

Conclusion

The sudden and unexpected decline of Aditya Birla Capital’s stock price has left investors reeling. While the short-term outlook may be uncertain, experts recommend taking a long-term view and considering the company’s strong track record and prospects for growth.

SEEKING ALPHA

Aditya Birla Capital

Financial Services

Stock Market

Investment

Portfolio Management

Trading

Market Volatility

Economic News

Global Economy

India Economy

KEYWORDS

Aditya Birla Capital, Stock Market, Financial Services, Investment, Portfolio Management, Trading, Market Volatility, Economic News, Global Economy, India Economy

Bought 10 stocks of Aditya birla capital and it soared down… should I hold it for future?

View info-news.info by Silent-Advisor9015

Remind me when it works out for you.

Bro i am holding 125 shares from 243

My mentors say

It’s good

Keep holding

Bhae 2300 rs m kya itni tension mutual fund m daldo aisi chijo k liye kon post krta h jyda velle ho kya

Damn 1.31% bro your cooked

Shit full 35 Rupees loss in 1 day

That’s like a black Monday thing

Hope you put in some hedges else you are cooked

Sala panauti, 10 shares leke stock gira diya manhus.