An increasing number of Silicon Valley investors and Wall Street analysts are starting to ring the alarm bells over the countless billions of dollars being invested in AI, an overconfidence they warn could result in a massive bubble.

As the Washington Post reports, investment bankers are singing a dramatically different tune than last year, a period marked by tremendous hype surrounding AI, and are instead starting to become wary of Big Tech’s ability to actually turn the tech into a profitable business.

“Despite its expensive price tag, the technology is nowhere near where it needs to be in order to be useful,” Goldman Sach’s most senior stock analyst Jim Covello wrote in a report last month. “Overbuilding things the world doesn’t have use for, or is not ready for, typically ends badly.”

Earlier this week, Google released its second-quarter earnings, failing to impress investors with razor-thin profit margins and surging costs related to training AI models. Capital expenditures are surging far past what the company had been spending previously, as the Wall Street Journal reports, with this year’s total spend expected to surpass $49 billion, or 84 percent higher than what the company averaged over the last five years.

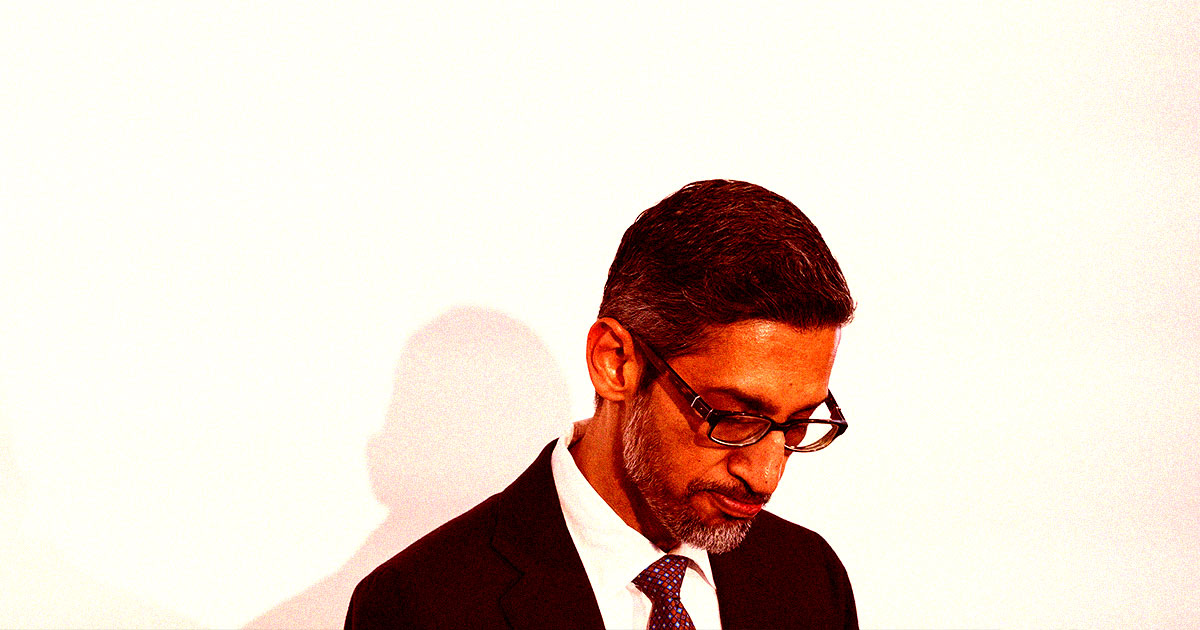

However, Google CEO Sundar Pichai is holding onto his guns, arguing that the “risk of underinvesting is dramatically greater than the risk of overinvesting for us here.”

“Not investing to be at the front here has much more significant downsides,” Pichai told investors on Tuesday.

Sure, the tech giant has a lot of cash to burn — but seeing any returns on those $49 billion will likely prove far more difficult. With the AI market clogged with products that are still mostly free, the tech costs a lot to run but isn’t bringing in much cash.

As such, Google is facing similar challenges to Microsoft and Meta, which are committing vast swathes of their available resources to AI without a clear monetization plan.

According to Barclays analysts, investors are expected to pour $60 billion a year into developing AI models, enough to develop 12,000 products roughly the size of OpenAI’s ChatGPT.

But whether the world needs 12,000 ChatGPT chatbots remains dubious at best.

“We do expect lots of new services… but probably not 12,000 of them,” Barclays analysts wrote in a note, as quoted by the WaPo. “We sense that Wall Street is growing increasingly skeptical.”

For quite some time now, experts have voiced concerns over a growing AI bubble, comparing it to the dot-com crisis of the late 1990s.

“Capital continues to pour into the AI sector with very little attention being paid to company fundamentals,” tech stock analyst Richard Windsor wrote in a March research note, “in a sure sign that when the music stops there will not be many chairs available.”

“This is precisely what happened with the Internet in 1999, autonomous driving in 2017, and now generative AI in 2024,” he added.

In a blog post last month, Sequoia Capital partner David Cahn argued that the entire tech industry would have to generate $600 billion a year to remain viable.

While “speculative frenzies are part of technology, and so they are not something to be afraid of,” he argued, AI tech is anything but a “get rich quick” scheme.

That doesn’t mean he’s entirely pessimistic, though.

“In reality, the road ahead is going to be a long one,” Cahn wrote. “It will have ups and downs. But almost certainly it will be worthwhile.”

But whether AI chatbots like ChatGPT will ever turn into cash-printing machines to recoup these enormous investments remains to be seen. As of right now, the cost of training these AI models and keeping them running is massively outpacing revenue.

How much time does the tech industry have to stop bleeding cash as it pours money into the tech?

If recent reports are to be believed, OpenAI may lose $5 billion this year and run out of cash in the next 12 months, barring further cash injections — an early warning sign that smaller companies already struggling to compete with Big Tech may be snuffed out before too long.

More on the AI bubble: Experts Concerned by Signs of AI Bubble

#Investors #Suddenly #Concerned #Isnt #Making #Money,

#Investors #Suddenly #Concerned #Isnt #Making #Money