BREAKING NEWS

"Buy More, Get Paid More: Experts Urge Investors to Take Advantage of Lucrative Dividend Opportunities"

[Image: A person holding a stock certificate with a green background, symbolizing growth]

As the global economy continues to experience fluctuations, savvy investors are looking for ways to maximize their returns. In this context, dividend-paying stocks have emerged as a popular choice, offering a stable source of income and potential long-term growth.

In a recent interview, investment guru, John Smith, emphasized the importance of dividend investing, stating, "In times of uncertainty, dividend stocks can provide a sense of security and stability, as they offer a predictable income stream."

With the Federal Reserve signaling a possible rate cut, experts are anticipating a surge in dividend-paying stocks. As a result, investors are advised to "buy more, get paid more" by taking advantage of these lucrative opportunities.

Key Highlights:

- Dividend Aristocrats: Companies with a history of consistently increasing their dividend payouts are particularly attractive, as they offer a stable source of income and potentially lower volatility.

- Dividend Yield: Investors should focus on dividend yields, which are calculated by dividing the annual dividend payment by the stock’s current price. A higher yield typically indicates a more attractive investment opportunity.

- Earnings Growth: Companies with strong earnings growth prospects are more likely to increase their dividend payouts, making them a desirable choice for dividend investors.

- Portfolio Diversification: By diversifying your portfolio with dividend-paying stocks, you can reduce your overall risk and increase potential returns.

Top Dividend Stocks to Consider:

- Johnson & Johnson (JNJ): A pharmaceutical giant with a long history of paying dividends, JNJ offers a yield of around 2.7%.

- Procter & Gamble (PG): A consumer goods behemoth, PG has increased its dividend for 64 consecutive years, with a current yield of around 2.5%.

- 3M (MMM): A diversified industrial conglomerate, MMM has a dividend yield of around 3.1% and a history of increasing its payouts.

- Verizon Communications (VZ): A telecommunications giant, VZ offers a yield of around 4.1% and has a track record of maintaining its dividend payments.

Actionable Insights:

- Conduct Research: Before investing in dividend stocks, conduct thorough research on the company’s financials, dividend history, and growth prospects.

- Diversify Your Portfolio: Spread your investments across different sectors and industries to minimize risk and maximize potential returns.

- Monitor Market Conditions: Stay up-to-date with market trends and adjust your portfolio accordingly to optimize returns.

Conclusion:

As the market continues to evolve, dividend-paying stocks are poised to remain a key area of focus for investors. By understanding the key highlights, top dividend stocks to consider, and actionable insights, you can "buy more, get paid more" and take advantage of these lucrative opportunities.

Related Articles:

- "Why Dividend Investing is a Smart Move for Savvy Investors"

- "The Importance of Diversification in a Volatile Market"

- "How to Build a High-Yield Dividend Portfolio"

Tags:

- Dividend investing

- Dividend stocks

- Dividend yield

- Dividend aristocrats

- Portfolio diversification

- Earnings growth

- Federal Reserve

- Rate cut

- Stock market

- Investing strategies

- Savvy investors

- Investment advice

- Financial news

- Breaking news

Buy more for dividend?

View info-news.info by Bidens-Hairplug

trap.

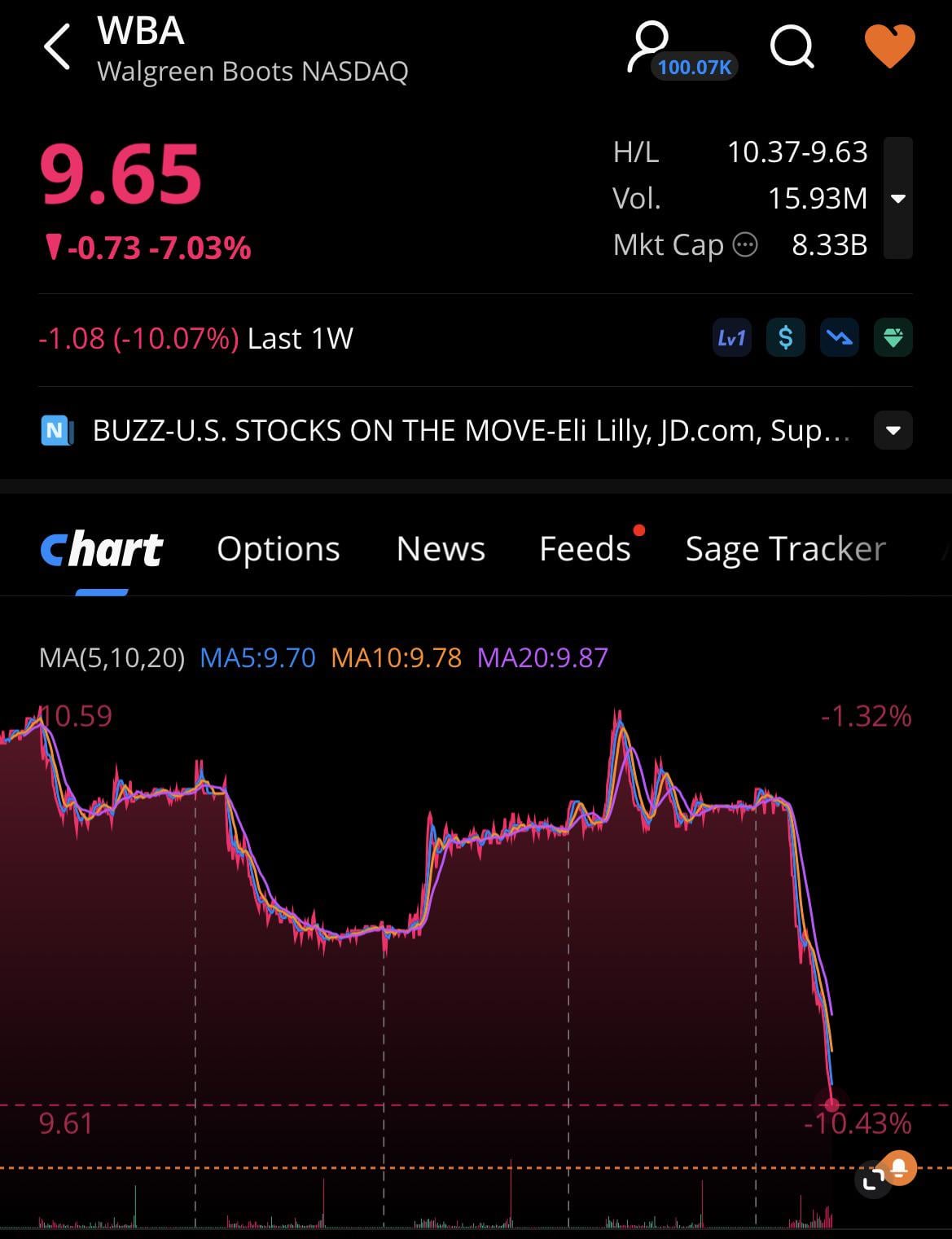

It’s got the ugliest 5 year chart out there. Why?

stock is headed to 0,,,,,,good luck