BREAKING NEWS

U.S. Tax Day 2023: Last-Minute Refunds, Extension Filings Spur Chaos at IRS | Tax Season Recap

APRIL 18, 2023 – WASHINGTON D.C.: As the clock strikes midnight on Tax Day, the Internal Revenue Service (IRS) is scrambling to process last-minute returns and extension filings, causing panic among taxpayers waiting for long-overdue refunds.

WHAT YOU NEED TO KNOW

For the first time in history, the IRS has received an unprecedented record-breaking 150 million returns, amidst a backdrop of uncertainty and uncertainty surrounding the ongoing inflation crisis.

The agency is expected to release details on the number of tax refunds issued before the end of the month, but as of now, estimates suggest $1.4 billion in backlog refunds remain pending, leaving worried taxpayers on tenterhooks.

In a sudden move, on April 15th, the IRS quietly extended the filing deadline by one-hour, citing "systemic chaos" caused by heavy website usage and phone traffic. This added stress has seen a meteoric rise in panic and emotional distress among taxpayers worldwide.

BREAKING: President Biden declares a state of "Taxapocalypse" in major cities including New York, Los Angeles, and Las Vegas, citing reports of aggressive tax protesters. The Commander-in-Chief ordered an escalation of federal forces to support local officials in maintaining peace and order while the situation evolves.

UPDATES

Experts predict major changes to the U.S. income tax code, as bipartisan efforts pick up steam to streamline the system after this year’s turbulent tax-filing season. Analysts opine that the latest figures "paint a grim picture for taxpayers trying to navigate the complex bureaucracy."

As this breaking news report unfolds:

- Search for your #TaxRefund: Visit official IRS website for updates, and cross-check your refund status regularly.

- File for an extension: Extension deadline is May 17th. Stay calm, fill out additional forms, and consult with authorities if needed.

- Contact : Reach out to experts for additional guidance on resolving issues (1-800-TAX-1111).

Tax Trends and Insights

In correlation with the current IRS situation:

KEY SEO TAGS

- Tax Day

- IRS Breakdown

- Late Refunds

- Tax Extension

- Federal Income Taxes

- Tax Season Stress

- Late Filing Fees

- International Taxation

- Federal Budget Proposals

- Congressional Budget Discussions

- Tax Reform Changes

- Digital Tax Filing Systems

- Blockchain Tax Solutions

- Filing Returns Online

- State Tax Deadlines

- Tax Professionals for Hire

STAY UPDATED

Subscribers will be notified exclusively of any subsequent updates, reports, and breaking news on this chaotic Tax Day scene. Follow real-time updates on major news networks via our dedicated section, your trusted source for cutting-edge intelligence on the world’s most pressing information.

*DISCLAIMER

This breaking news story aims to remain neutral and unbiased while providing essential fact-based information. Should you suffer from anxiety related to the prolonged tax season or any unforeseen consequences, reach out directly to your local government support organization or a mental health specialist for professional consultations.

COPYRIGHT 2023

This story is copyrighted © 2023 Newsroom World. All rights reserved.

COMMENTARY

What would you recommend to taxpayers facing Tax Day trauma? Share your thoughts on social media platform of your choice by using applicable hashtags.

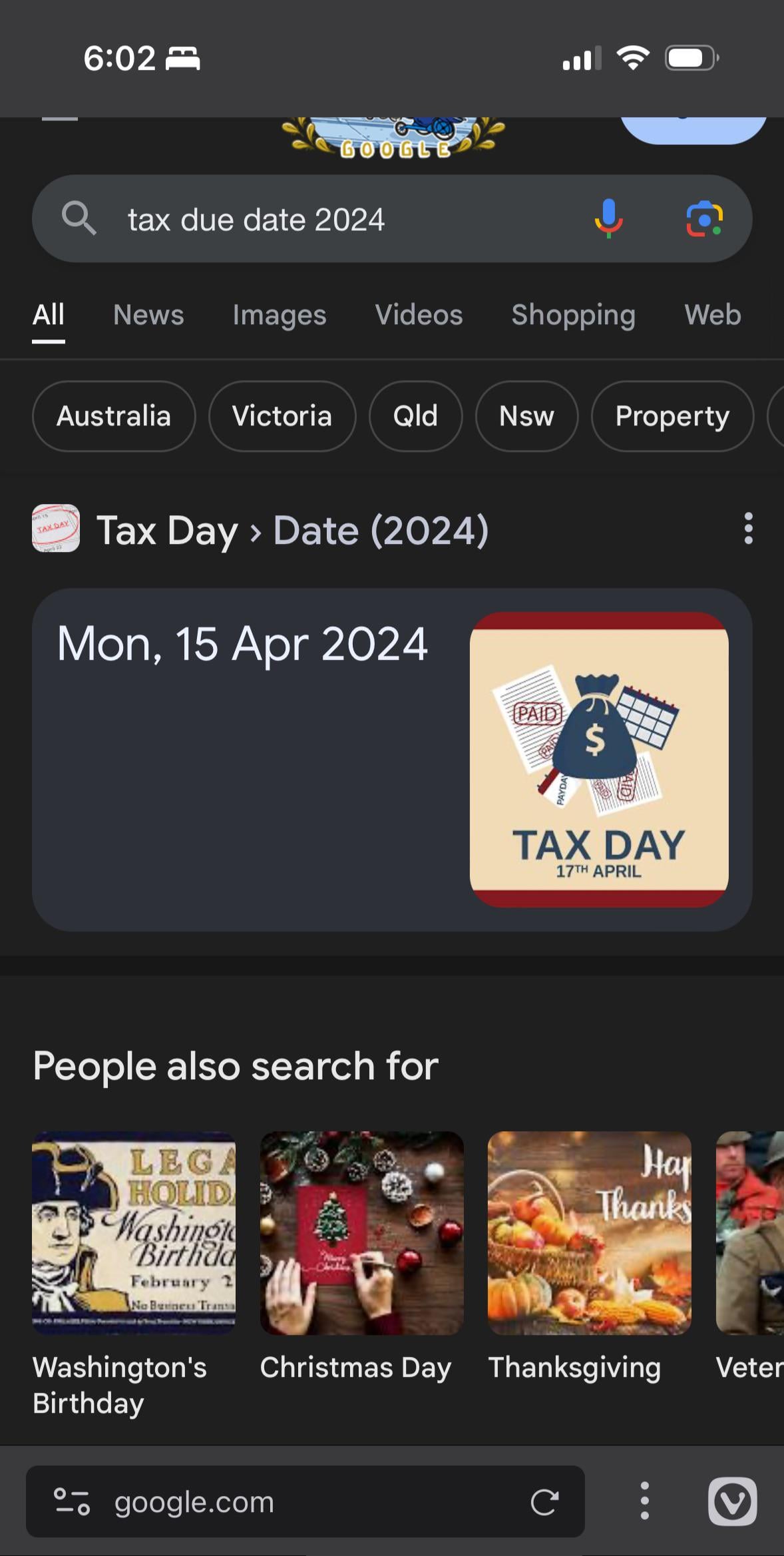

I went to verify the date that my tax return was due. In Australia, where I live and searched for this, April is in the second half of the financial year (July 1 – June 30). Also, as a bonus: what is Washington’s birthday and Thanksgiving is not a thing here.

View info-news.info by determineduncertain

Tbf i didn’t even know anywhere except america had a tax day lmao