(Bloomberg) — The new class of weight-loss drugs being tested as cure-alls for everything from knee replacements to liver disease keeps throwing corners of the stock market into disarray.

Most Read from Bloomberg

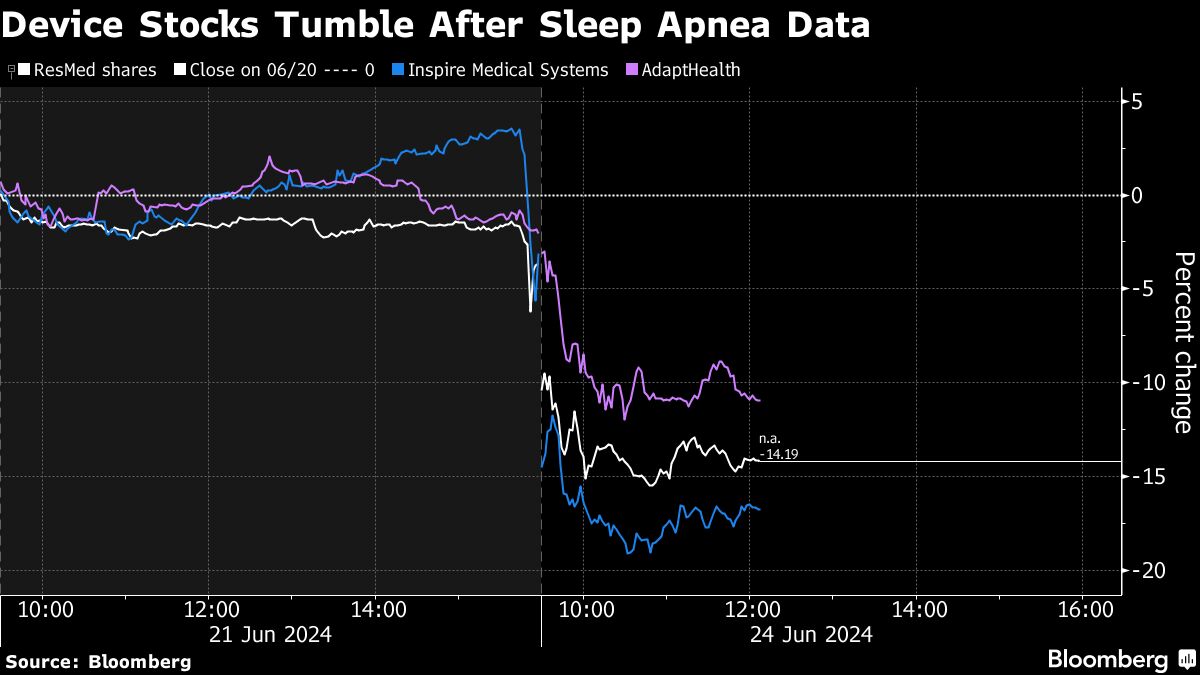

Late Friday, data for tirzepatide — the chemical compound Eli Lilly & Co. sells as Mounjaro and Zepbound — shook markets once again as makers of machines for sleep-related disorders tumbled. The data showed Lilly’s blockbuster weight loss and diabetes medicine reduced the severity of obstructive sleep apnea in obese patients.

ResMed Inc., which makes breathing machines known as CPAP devices, fell about 11% Monday, its steepest drop in more than 10 months. A maker of sleep apnea implants, Inspire Medical Systems Inc., tumbled 17% hitting the lowest level since November. AdaptHealth Corp., home medical-equipment provider which sells sleep therapy supplies, slumped 8.1% — the most since December.

The results presented at the American Diabetes Association meeting were lauded as a “breakthrough trial in the history of the treatment of obesity and sleep apnea,” according to Louis Aronne, an obesity specialist at Weill Cornell Medicine.

Health-care device makers have been coming under increasing pressure as data piles up showing just how wide-ranging the effects of weight-loss drugs could be on conditions linked to obesity. The latest stocks selloff is an echo of a year ago, when makers of diabetes devices including Insulet Corp. and Tandem Diabetes Care Inc. plunged on fears that the blockbuster GLP-1 drugs would transform the sector and wreak havoc on sales. Insulet fell about 26% in 2023 while Tandem lost 34%.

Analysts at Citigroup Inc. downgraded their rating on ResMed to neutral from buy, writing the latest results show “a risk that a portion of mild patients may drop CPAP therapy over time.”

Meanwhile, Truist Securities sees the weight-loss overhang extending for Inspire. It “will likely continue to be a battleground (and volatile) stock for the next few months,” according to analyst Richard Newitter, “or at least until investors can get more confident that utilization is back on a sustainable growth trajectory in 2024 and into 2025.”

Initial results from Lilly’s trial had been reported in April with investors bracing for impact from the full details of the study. The new data raises more questions than answers for the device makers, according to Stifel analyst Jonathan D Block.

Lilly’s “impressive results further increase the chances that Sleep Specialists make GLP-1s a more integral part of the treatment paradigm,” Block wrote in a note.

(Updates with closing prices throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

#Lilly #WeightLoss #Drug #Data #Spurs #Selloff #Sleep #Apnea #Stocks,

#Lilly #WeightLoss #Drug #Data #Spurs #Selloff #Sleep #Apnea #Stocks